It’s difficult to find any new smartphone without NFC compatibility these days. It’s beloved by many users as it’s making processes like payments much quicker and more convenient. People who have used apps like Google Pay or Apple Pay have already been using NFC. But payments aren’t all NFC is good for. Recently, NFC verification has come into play with KYC compliance, and it might be the game changer you need when scanning identity documents.

What is NFC and How Does It Work?

Near-Field Communication (NFC) is a short-range wireless technology that allows NFC-compatible devices to communicate with NFC chips. This results in the quick transfer of data. For people unfamiliar with NFC technology, it might seem similar to Bluetooth. However, NFC wins in being more efficient and focusing on other communication aspects like confirmation of specific data. This makes NFC identification synonymous with mobile identity verification and much more accessible to many clients.

There are two main parts that go into near-field communication. They are NFC chips and NFC compatibility. Let’s look into them.

What are NFC Chips?

NFC chips are small circuits made up of an antenna and the chip itself. A contained NFC chip may look like a small plastic circle (referred to as an NFC tag) or a plastic card. However, the more common way they are encountered is inside something else. For example, biometric identity documents such as passports or ID cards.

The antenna allows the NFC chip to interact with an NFC reader by creating an electromagnetic field. This field is then used for wireless data communication, such as NFC-based identity verification.

What is NFC Compatibility?

NFC compatibility is available on any device that is able to read the NFC technology. For example, a phone with NFC enabled can read any NFC-embedded card (i.e. credit card, ID document).

With these elements, NFC communication can happen anywhere as long as the NFC chip and NFC-compatible device are within 5 centimetres of each other. Once the NFC chip sends over data, the NFC reader or, in this case, the phone is also given a command on what to do with the data.

How are NFC Chips Used for Identity Verification?

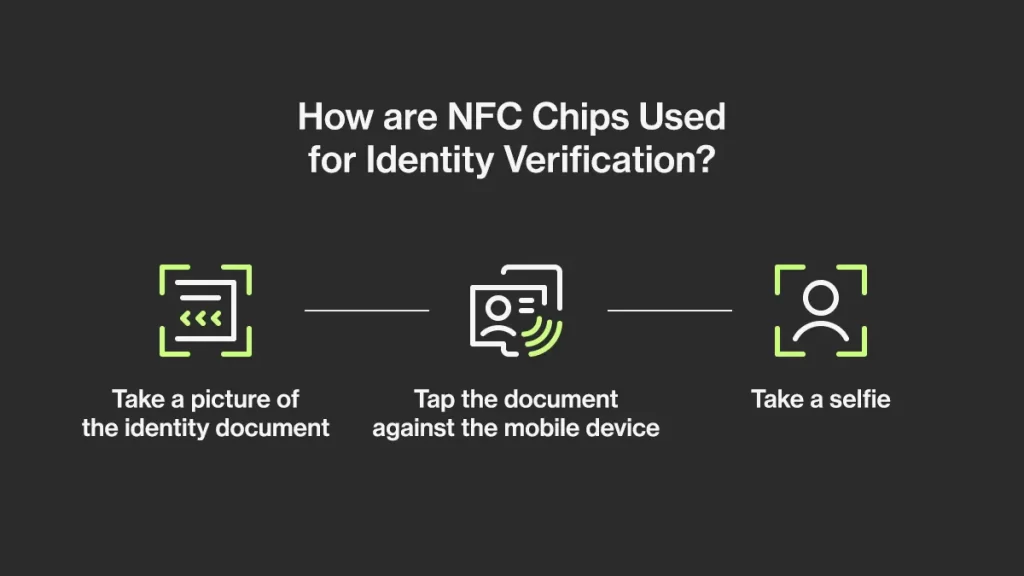

Keeping the above explanations in mind, NFC Identity verification is a much more convenient way to confirm someone’s identity. Rather than manually inputting the details on their identification documents, people can now leave this to their phones. Simply pressing their documents to NFC-compatible devices allows these devices to scan the information and compare any relevant biometric data. This makes document verification much more convenient.

With Ondato, this is achieved in three easy steps:

The Pros and Cons of NFC Verification

Advantages

NFC-based identity verification provides a range of benefits to consumers and businesses.

- Simplicity: It’s as simple as tapping your document against your phone. And since most modern phones now come with NFC compatibility, NFC verification is accessible to many potential customers.

- Security: NFC identity verification is considered to be one of the safest ways to scan data, as there is no known way to tamper with NFC chips.

- Fraud prevention: NFC can easily detect any forged documents in real-time. This means that any fraud risk is minimized with NFC verification.

- Speed: The one tap process speeds up customer verification which makes customer drop-off rates much lower.

However, as with any new innovation, NFC technology also has its drawbacks.

Disadvantages

As great as increased security, speed, and convenience are, there are drawbacks your business should be aware of before choosing NFC technology:

- Price: As you can assume, any new technology starts up with higher costs due to development, implementation and possible future updates. Which is why some places of the world might lack in the number of chip embedded ID documents.

- Unfamiliar technology: As it’s still quite new, many people are unfamiliar with NFC verification and would rather opt for older methods instead.

It’s important to remember that NFC technology might not work for you or your clients. However, Ondato has your back when choosing any option.

Other Identity Verification Methods

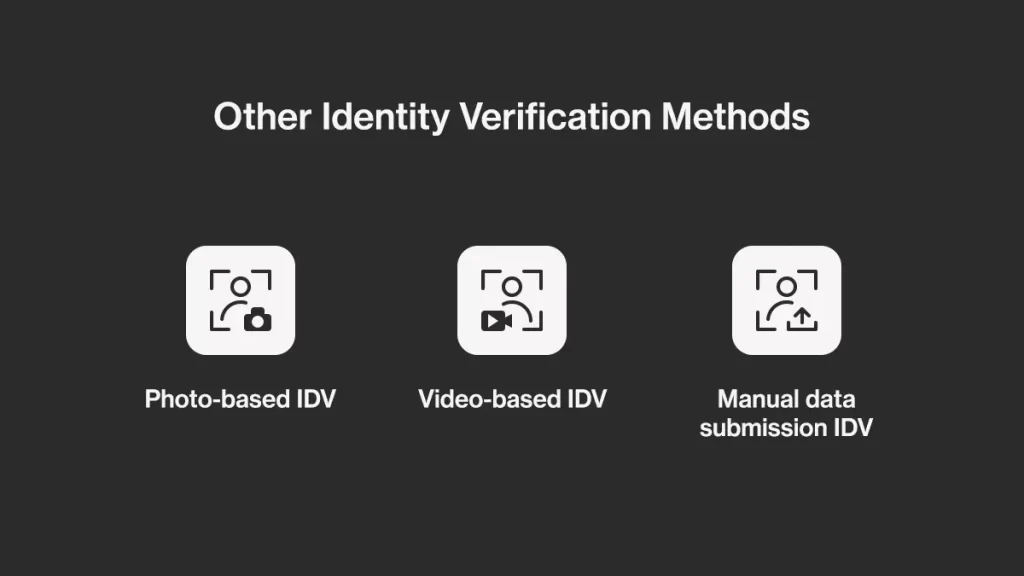

Although great, NFC identity verification isn’t the solution for every company. Let’s take a quick look at the other secure identity document verification methods available in the identity verification industry.

Photo-based IDV: As the name suggests, this identity verification process includes taking a picture of the customer to compare against their identity documents. It’s considered one of the most accessible methods and is most often used by banks or other financial institutions.

Video-based IDV: This method allows companies to keep the identification process smooth and remote while building rapport with their customers. Additionally, with Ondato, any business has the choice between using their own KYC agents for video calls or outsourcing the job to Ondato’s agents.

Manual data submission IDV: Allows customers to provide their documents at their convenience and have them checked at yours. Combines the best parts of manual identification with automated verification, as all the documents are still checked for spoofing and fraud attempts through Ondato’s KYC tools.

Your Choice is Easy with the Right Product

Whether you want to try out the newest KYC methods or stick with the true and tested tools, Ondato has you covered. As your business grows, we offer the possibility to scale and flexible solutions depending on the regulations your company has to follow. This ensures you can best match your KYC process to the needs and possibilities of your clients to ensure they have a smooth experience.